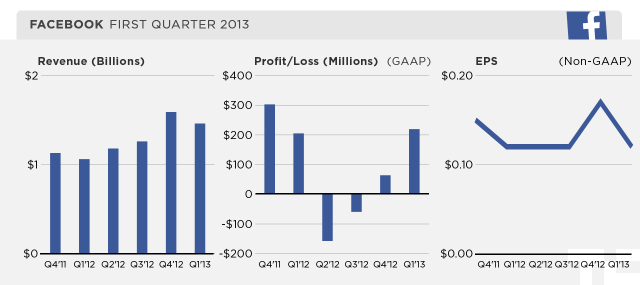

Facebook has just posted its earnings for the quarter that ended March 31, 2013. Facebook hit $1.46 billion in revenue up 38% from Q1 2012, beating Wall Street estimates of sales of $1.44 billion.

Net income was up 7% to $219 million, versus $205 million a year ago (GAAP figures).

Mobile ad revenue for the quarter ending March 31, 2013 was $375 million, accounted for 30% of the company’s total ad revenues. That is up from 23% in the last quarter of 2012.

COO Sheryl Sandberg claimed that Facebook ads helped drive “25 million” app downloads. (Essentially, developers pay to promote their app inside a user’s Newsfeed. Click on the ad and go straight to Google Play or Apple’s App Store.) Zuckerberg added that, “I think it’s clear now that we can create a lot of value for [developers] by providing identity. We’re starting to see real revenue from mobile app installs.” The company said 40% of top-grossing iOS and Android apps were promoted on Facebook.

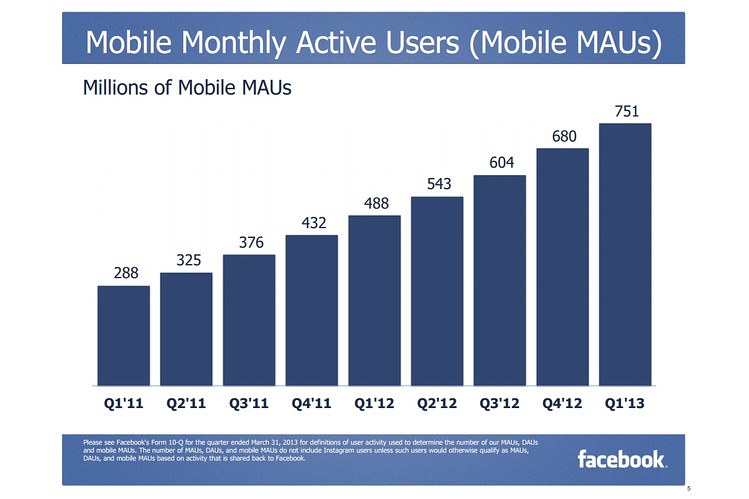

Facebook boasted 751 million mobile “monthly active users”– a 54% increase over the same quarter last year and 71 million more than it registered in the fourth quarter of 2012.

First Quarter 2013 Operational Highlights

- Daily active users (DAUs) were 665 million on average for March 2013, an increase of 26% year-over-year.

- Monthly active users (MAUs) were 1.11 billion as of March 31, 2013, an increase of 23% year-over-year.

- Mobile MAUs were 751 million as of March 31, 2013, an increase of 54% year-over-year.

First Quarter 2013 Financial Highlights

Revenue — Revenue for the first quarter totaled $1.46 billion, an increase of 38%, compared with $1.06 billion in the first quarter of 2012.

- Revenue from advertising was $1.25 billion, representing 85% of total revenue and a 43% increase from the same quarter last year.

- Mobile advertising revenue represented approximately 30% of advertising revenue for the first quarter of 2013.

- Payments and other fees revenue was $213 million for the first quarter of 2013.

Costs and expenses — First quarter GAAP costs and expenses were $1.08 billion, an increase of 60% from the first quarter of 2012, driven primarily by infrastructure expense and increased headcount. Non-GAAP costs and expenses were $895 million in the first quarter, up 56% compared to $573 million for the first quarter of 2012.

Income from operations — For the first quarter, GAAP income from operations was $373 million, down 2% from $381 million in the first quarter of 2012. Excluding share-based compensation and related payroll tax expenses, non-GAAP income from operations for the first quarter was $563 million, up 16% compared to $485 million for the first quarter of 2012.

Operating margin — GAAP operating margin was 26% for the first quarter of 2013, compared to 36% in the first quarter of 2012. Excluding share-based compensation and related payroll tax expenses, non-GAAP operating margin was 39% for the first quarter of 2013, compared to 46% for the first quarter of 2012.

Provision for income taxes — GAAP income tax expense for the first quarter of 2013 was $134 million, representing a 38% effective tax rate. Excluding share-based compensation expense and related payroll tax expenses, the non-GAAP effective tax rate would have been approximately 43%.

Net income and EPS — For the first quarter, GAAP net income was $219 million, up 7% compared to net income of $205 million for the first quarter of 2012. Excluding share-based compensation and related payroll tax expenses and income tax adjustments, non-GAAP net income for the first quarter of 2013 was $312 million, up 9% compared to $287 million for the first quarter of 2012. GAAP diluted EPS was $0.09 in the first quarter of 2013. Excluding share-based compensation and related payroll tax expenses and income tax adjustments, non-GAAP diluted EPS for the first quarter of 2013 was $0.12, essentially flat compared to the first quarter of 2012.

Capital expenditures — Capital expenditures for the quarter were $327 million, a 28% decrease from the first quarter of 2012. Additionally, $11 million of equipment was procured or financed through capital leases during the first quarter of 2013.

Cash and marketable securities — Cash and marketable securities were $9.5 billion at the end of the first quarter of 2013.

Credits: ReadWrite, TechCrunch