Most of the startup entrepreneurs and even small businesses outsource their payroll systems. Startup entrepreneurs outsource it to freelancing accounts experts and SMBs outsource it to other HR and accounts maintaining SMBs.

There’s nothing wrong in it, because managing payrolls is a complex task, you need to take care of the taxes as well, and specially in cases where you have your in house employees as well as freelancers working for you.

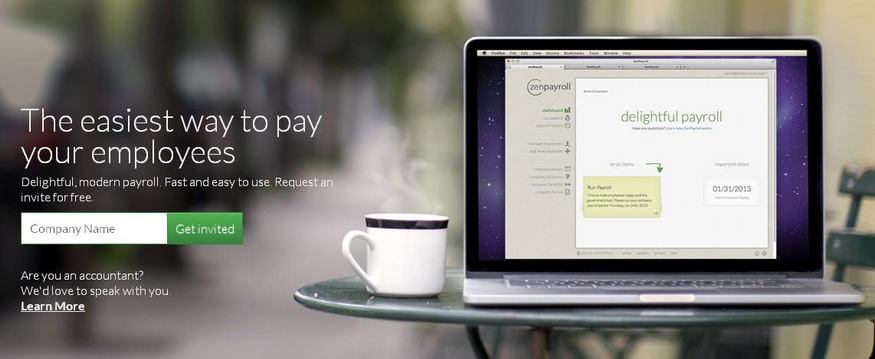

ZenPayroll, its not an app, its an online payroll system, which takes out the pain and complexity of dealing with payrolls.

ZenPayroll seems to have got a really deep research on the payrolls and tax systems.

I would like to share a little excerpt from their blog post, “Employees or Contractors? Misclassifying Workers Can Cost Your Business“, I recommend you read the complete article and understand, for me it was like an eye opener, i never really thought, how seriously the employee and contractor difference would matter and wherein lies the real benefit for a startup.

The Cost of Misclassification:

When hiring an employee can cost 25-30% more than hiring an independent contractor, it’s clear to see the benefit to employers. Government figures estimate 25-30% of all employees are misclassified as independent contractors.

And that is because, “generally, you must withhold income taxes, withhold and pay Social Security and Medicare taxes, and pay unemployment tax on wages paid to an employee. You do not generally have to withhold or pay any taxes on payments to independent contractors,” the IRS explains.

But regardless of whether the misclassification was intentional or unintentional, your business could face serious legal and financial consequences for doing so. This could include reimbursement for unpaid wages, including overtime wages, paying the individual’s workers’ compensation benefits, retirement contributions, employee benefits, Medicare and Social Security contributions, unemployment insurance, health insurance, and any other employee-related costs like back taxes and any applicable penalties for state and federal income taxes.

A unique feature provided for the employees, they can store their salary slips i.e. earning statements called as paystubs, in their google drive.

Now coming to the real beneficial feature of ZenPayroll, the AutoPay.

If you have salaried employees or direct deposits to make, and its the same amount every month, then you can use the AutoPay feature, its like set-and-foget, you just need to enable AutoPay from your system settings. The system will process each pay period one day before the deadline.

It will send you a reminder email 2 days before the next payroll executes, in case you need to make any changes or want to cancel it.

The overall UX and UI is neat and composed and easy to use, liked that.

At present ZenPayroll is available for United States only, but they have plans to expand, you can ask for your country at the ZenPayroll International page and they’ll surely get back to you.

Photo Source: rahat_javed78k