It’s easy to forget the big picture when you report on a quarterly earnings. Apple has seen a tremendous year. With $156 billion in revenue representing 45 percent growth compared to 2011, and an incredible 61 percent increase of net income compared to 2011. But even more impressive, Apple now has $121.3 billion in cash, enough to buy Amazon or a space station, and still having some left.

Amazon’s market capitalization ticks at $100.77 billion today. And many of what you could consider big tech companies have a smaller market cap. Yahoo’s market cap is $19.68 billion, Facebook’s is $48.33 billion. And let’s not compare to Dell or HP who have a $16.03 billion and $27.90 billion market cap.

As long as Apple keeps generation such profits, there is no end to this cash pile. Three months ago, Apple had $117.2 billion in the bank (short term financial investments or equivalent).

Apple has been very shy when it comes to acquisitions. Over the years, it has only bought a handful of companies, including Lala, Chomp and Siri.

Even compared to Apple’s own market capitalization, its cash represents more than 20 percent of its gigantic $571.38 billion market cap. Yet, the ratio cash versus market cap is slowly going down, because Apple shares are raising even more. Here’s the percentage evolution:

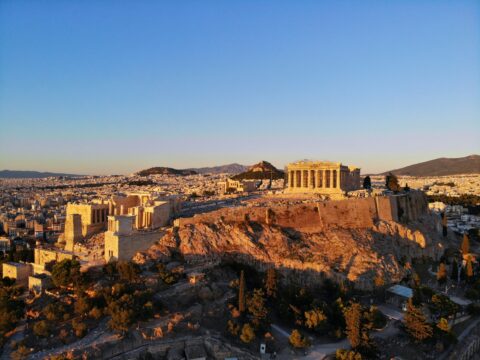

And of course, there are the funny comparisons. Beautiful buildings and monuments are cool, but let’s not stop there. As we’ve learned recently, a space station “only” costs around $100 billion. Space is the next frontier, right?

Via: TechCrunch