Shareholders of Hewlett-Packard had a rough time last week. Having endured the fall of HP shares to a seven-year low last month, they have had to stand by as the numbers have gotten even worse.

On Friday, HP shares set yet another ignominious milestone, hitting $18.98 a share and trading at the lowest levels seen since late 2004, falling nearly 2 percent on a day when the Dow Jones Industrial Average rose by more than 1.6 percent.

The fall came in partial reaction to an earnings warning from printer company Lexmark, which slashed its second-quarter sales and profit forecasts, blaming slackening demand in Europe and unfavorable currency conditions. Lexmark shares fell by more than 16 percent.

Naturally, investors worried that a bad market for printers would have to hurt the world’s largest maker of printers, as well. It’s certainly not an unreasonable conclusion: HP’s printer unit — recently combined with its PC unit — accounted for 20 percent of sales and 36 percent of operating profits last quarter. And it’s not as if the indications for the printer business weren’t already dour. HP has struggled with its own version of currency difficulties: Since many key printer components are made in Japan, the strong yen has continued to add a currency headwind to an already challenged market for printers and printing supplies.

A pronounced weakness in the printing business is one thing, but there were other alarm bells. Last week’s PC sales figures from Gartner and IDC suggest that HP’s PC sales fell by about 12 percent and change, with a lot of market ground given to China’s Lenovo. Not good for the world’s leading PC vendor.

Add to that sales of HP servers — HP is the world’s leading vendor in that market, too, which fell by nearly 10 percent in the first quarter, according to Gartner and IDC — and the case for optimism has dwindled substantially.

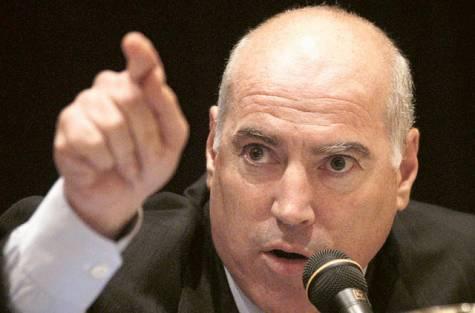

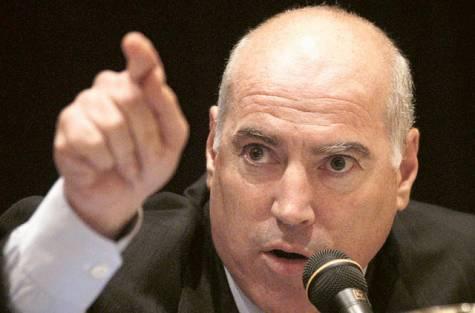

Whitworth (pictured) took a seat on HP’s board of directors in November of 2011 after disclosing that Relational had acquired about 17.3 million shares as of Sept. 30 amounting to about 1 percent of HP’s outstanding equity.

Whitworth (pictured) took a seat on HP’s board of directors in November of 2011 after disclosing that Relational had acquired about 17.3 million shares as of Sept. 30 amounting to about 1 percent of HP’s outstanding equity.

Since then, Whitworth has been buying a lot more HP shares: As of June 1, SEC filings (see the most recent one here) show that Whitworth, through Relational, has doubled his holdings in HP, and now controls more than 34.5 million shares, a stake that is approaching 2 percent of the shares outstanding. That would put Relational on track to be the eighth-largest institutional holder of HP shares. In short, you have to go pretty far to find an HP shareholder with more skin in the game than Ralph Whitworth.

And there’s no way that Whitworth can be happy with HP’s performance of late. In May alone, Relational spent more than $407 million accumulating HP shares, at average prices ranging from $22.02 to $22.71. All told, Relational has, since last August, spent more than $790 million — or more than 13 percent of the funds it has under management — on HP shares that as of Friday were worth less than $656 million, representing a drop in value of about 17 percent.

This all makes Whitworth’s voice in HP’s board meetings all the more weighty. As a condition of taking the board seat, Whitworth agreed not to publicly seek HP’s sale or merger with another company or a spinoff of any of its assets. Whitworth will no doubt have other levers to pull. And nothing in the agreement forbids him from arguing for any course of action behind the closed doors of HP board meetings.

At this point, it’s worth looking at Whitworth’s history: Last June, after acquiring a 6 percent stake L3 Communications, Whitworth pushed for a breakup of that company. The result was the spinoff of a $2 billion unit that is to be called Engility.

Also in 2011, after amassing a stake of nearly 4 percent, Whitworth pushed for — and ultimately won — the breakup of the industrial conglomerate ITT. In that case, Whitworth threatened a nasty proxy fight by nominating himself and two other Relational officers to that company’s board. It ultimately broke itself into three publicly held pieces: ITT, ITT Excelis, and Xylem.

Whitworth’s latest target appears to be soft-drink giant PepsiCo. Having accumulated a stake amounting to about 0.6 percent of its shares outstanding, he is said to have agitated for the separation of its slow-growing beverage business from its faster-growing snacks line.

His biggest coup was at Home Depot, where he pushed the company to get out of the commercial building-supply business, which ultimately led to the resignation of then-CEO Robert Nardelli.

These examples of Whitworthiana are notable in light of a call by J.P. Morgan analyst Mark Moskowitz’s July 13 note to clients arguing that HP should indeed break up: As Barron’s noted that day, Moskowitz thinks HP will have to reinvest cost savings from thecombination of its printer and PC divisions into reengineering of its business model.

Moskowitz goes on: If HP’s strategic intent is to build up its enterprise IT solutions business, PCs and printers become less integral. Naturally, this brings to mind last August’s disastrous plan to spin off the PC-making personal systems group, a decision that, combined with the $11.7 billion acquisition of Autonomy, cost then-CEO Léo Apotheker his job.

Apotheker’s successor, Meg Whitman, quickly killed the spinoff plan after assuming the CEO slot, arguing that the PC business gives HP the scale it needs to compete effectively in other hardware businesses, including servers and printers. But given the growth prospects of both for the forseeable future, the pressure to carve HP up into parts will only grow.

But make no mistake: It’s an idea that Whitman firmly opposes: In a June 5 interview with AllthingsD, she reiterated her opinion that HP is strongest in its current sprawling form: Asked if she saw any scenario where any piece of HP was cut off from the whole, she was abundantly clear: “As I see it, everything stays,” she said at the time.

One has to wonder if, given his history of agitating for sweeping change at so many large and troubled companies, HP’s newest director and eighth-largest shareholder sees it in quite the same way.

Via: All Things D